Tools

IRS Compliant Vehicle Mileage Log Template

Easily track and organize mileage records for your drivers and operators. Our printable mileage log template helps you generate IRS-compliant reports, replace outdated paper logs and improve oversight of vehicle usage for your entire fleet. Stay audit-ready and optimize vehicle tracking — all with a simple, free, download. Downloaded by more than 650 fleets.

Benefits of using a mileage log

By tracking mileage in a spreadsheet, you can easily surface information around individual vehicles or operators. Plus, the information is printable in case you ever need a physical copy in the case of an IRS audit:

- Keep a historical record of what work has been performed on an asset and how much it costs.

Benefits of using a mileage log

By tracking mileage in a spreadsheet, you can easily surface information around individual vehicles or operators. Plus, the information is printable in case you ever need a physical copy in the case of an IRS audit:

Ongoing log of mileage entries

Download Free Template

Fill out the form to receive a download link for your free mileage log template

Jump to a topic

Content Overview

Need a reliable way to track business mileage? This guide includes a free, IRS-compliant mileage log template and walks through how to use it effectively. Learn what fields are required, how to avoid common mistakes, and why software can save time as your fleet grows.

What is a mileage log template?

A mileage log template is a ready-made document designed to help drivers and fleet managers record trips, odometer readings and trip purposes. Whether you're managing a growing fleet or driving your personal vehicle for work, keeping an accurate mileage log is essential for:

- Claiming tax deductions

- Calculating reimbursements

- Staying compliant with IRS guidelines

At its core, a mileage log is about transparency and accountability – tracking how and why a vehicle was used so that teams and tax authorities both have a clear, audit-ready record.

Key reasons fleets need one

Mileage logs serve more than just tax purposes. They’re a practical tool for improving operations, reducing costs and staying proactive with maintenance. Here’s why logging mileage matters:

- Proves business use for tax deductions and audits: IRS audits often focus on vehicle-related expenses. A compliant log reduces risk and simplifies reporting.

- Supports mileage-based preventive maintenance: Logging odometer readings ensures service schedules align with real-world usage, not guesswork.

- Improves cost-per-mile and asset utilization tracking: Tracking mileage helps identify underused or overused assets and enables smarter replacement timing.

- Enables accurate reimbursement processes: For organizations reimbursing team members, a consistent log prevents disputes and ensures fairness.

Relying too heavily on individual staff, a calendar on the wall, or walking around the yard checking [vehicles] – it just doesn't work. You need something where you've got metrics that are coming in and vehicles getting flagged for reminders, and operating within the system to then bring them in for the service. Josh Baker, DASH Public Transit

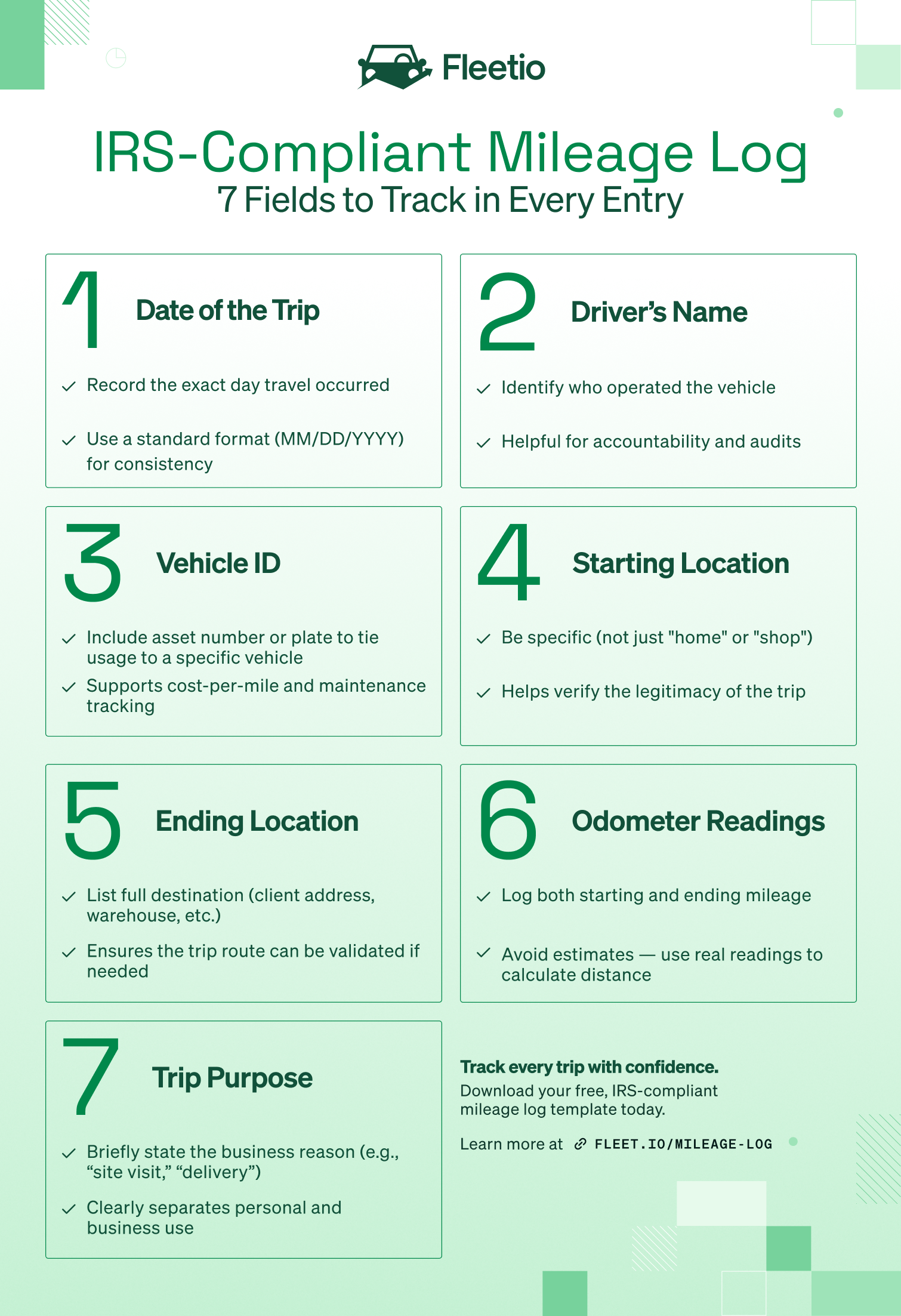

What fields should your mileage log include?

Keeping a mileage log is only helpful if the right information is captured consistently. From tax documentation to internal tracking, the fields you include directly affect how useful (and audit-proof) your log really is.

Whether you’re using a spreadsheet or a digital platform like Fleetio, a complete mileage log should answer five key questions:

- Who drove the vehicle?

- Which asset was used?

- When and where did the trip happen?

- How far was the vehicle driven?

- Why was the trip taken?

Required IRS documentation elements

The IRS has strict standards for what qualifies as a business mileage deduction. To remain compliant and prepare for potential audits, each log entry should include:

- Date of the trip – The actual day the travel occurred

- Driver name – Who operated the asset on this trip

- Vehicle identifier – License plate or fleet asset ID

- Starting location and destination – Enough detail to identify the route taken

- Beginning and ending odometer readings – To verify total miles driven

- Total miles driven – Based on odometer, not estimation

- Purpose of the trip – Business-related explanation (e.g., client meeting, delivery)

Note

IRS mileage requirements apply across the United States. Be sure to also check for any state-level mileage or reimbursement rules if applicable.

Included in the free Fleetio template

Fleetio’s downloadable mileage log template goes beyond the basics to help your team track usage efficiently and spot issues early. Here’s what’s included:

- Prebuilt vehicle list with editable fields for asset IDs, types, and driver assignments

- Operator comments field for noting trip anomalies or context (e.g., “unexpected detour,” “idling due to delivery delay”)

- Checkbox for vehicle attention to quickly flag any asset that may need a follow-up or inspection

- Assignment history view to see full mileage logs by asset, making it easy to identify trends or discrepancies

How to use this mileage spreadsheet effectively

A mileage log is only as good as the habits behind it. To get the most value from your spreadsheet (and avoid last-minute scrambling during tax season) follow these tips for consistent, error-free usage.

Tips for reducing entry errors

The more mileage logs you manage, the more important accuracy becomes. Small mistakes can snowball into tax issues, delayed maintenance, or unfair reimbursements. Here’s how to avoid them:

- Assign logs by vehicle or driver. Keep records clean by organizing entries by asset or operator – not by day or department.

- Use dropdowns and validation where possible. Reduce typos and inconsistencies with pre-populated categories like “Delivery,” “Client Visit” or “Fuel Stop.”

- Review logs on a regular cadence. Weekly or biweekly check-ins help catch gaps or mistakes before they become audit risks.

- Use digital storage, not paper stacks. Upload completed logs to a shared folder or fleet system – easily accessible, version-controlled, and searchable.

Pro Tip

Log mileage right after a trip ends – it’s fresher, faster and more accurate.

Storing and sharing your logs

IRS rules require you to retain mileage records for at least three years. But accessibility is just as important as compliance. Here’s how to make sure your team can find and reference logs when needed:

- Save logs in a centralized digital location — think cloud storage or a fleet management platform.

- Label files consistently by asset ID, date range or driver name.

- Set permissions so finance, operations, or auditors can access files without back-and-forth emails.

- Back everything up — one hard drive crash shouldn’t compromise your tax documentation.

Spreadsheets work – until they don’t

With Fleetio Go, drivers can log mileage from the field – no spreadsheets, no delays. Get instant visibility into asset usage and keep records IRS-ready, in real time.

Simplify mileage trackingTips to stay IRS-compliant

Mileage logs can unlock significant tax benefits – but only if they're kept correctly. The IRS doesn't require a specific format, but they do expect consistency, accuracy and timely recordkeeping. Here’s how compliant and non-compliant mileage tracking typically compares.

IRS-compliant vs. non-compliant mileage logs

| Feature/Behavior | ✅ IRS-Compliant | ❌ Non-Compliant |

|---|---|---|

| Trip recorded immediately | Logged right after trip, while details are fresh | Reconstructed later from calendar or memory |

| Purpose documented | Each entry clearly states business reason | Missing or vague trip reasons (e.g., "meeting") |

| Odometer readings used | Includes start and end readings per trip | Uses rough estimates or apps without verification |

| Driver and vehicle identified | Includes driver name and vehicle ID or plate | Generic logs without attribution |

| Stored and backed up | Saved digitally and retained for 3+ years | Paper logs or single file with no backup |

| Miles vary naturally | Reflects real, irregular totals (e.g., 132.7 mi) | Rounded numbers (e.g., “100 miles every trip”) |

| Business and personal separated | Clearly separated or notated | Mixed entries without distinction |

Common audit triggers

The IRS closely scrutinizes mileage deductions because they’re easy to inflate. Some of the most common red flags that trigger audits include:

- Rounded numbers: Reporting exactly 10,000 miles per year looks suspicious, logs should reflect real, varied totals

- Inconsistent or missing trip purposes: Every entry should clearly explain why the trip was taken

- Logs recreated from memory: Manually compiling a log at year-end is risky and rarely accurate

- Personal and business mileage mixed together: Always differentiate, even if the trip is partially business-related

Pro Tip

If your logs include too many “estimates,” the IRS may disallow your mileage deduction entirely.

How to avoid mistakes

Protect your deductions (and your peace of mind) by building mileage tracking into your team’s regular workflow. Here’s how:

- Log mileage immediately after each trip. Delays lead to gaps, forgotten stops, or inaccurate odometer readings.

- Use odometer-based tracking. It’s far more reliable than app-based estimation alone.

- Keep logs organized by asset or driver. Especially helpful if you manage a mixed-use fleet.

- Back up your records. Cloud storage, email copies, or a fleet management system like Fleetio can ensure nothing is lost in a pinch.

Mileage records don’t just support taxes – they also show you're being a good steward of your fleet’s budget, usage and lifecycle.

Why software beats spreadsheets for growing fleets

Spreadsheets can work well when you're managing a handful of assets – but as your team, trips or reporting requirements grow, so do the challenges. Manual mileage logs often lead to:

- Missed or inconsistent entries

- Delayed maintenance triggers

- Time-consuming audits and reimbursements

- Scattered or inaccessible records

One of the things Fleetio has forced us to learn is accuracy, because – if there’s a mistake made – everything is interconnected. It affects the mileage that’s shown on the vehicle, the reminders for vehicle maintenance; it messes up everything. Now, [our operators] understand how important it is to be very cautious about inputting your information. Robert Johnson, Kayak Public Transit

That’s where software can help. A digital mileage tracking system like Fleetio allows your team to:

Save time with automation

Instead of chasing down spreadsheets or manually entering data, Fleetio lets you:

- Capture mileage automatically from integrated telematics providers like Geotab, Motive and Samsara

- Enable mobile entry with Fleetio Go, so drivers can log mileage instantly

- Schedule reminders for mileage-based maintenance without checking odometers

- Flag exceptions early, like sudden mileage jumps or missed entries

Maintain audit-readiness at scale

With Fleetio, you don’t have to worry about finding the right log or tracking down who drove what.

- Centralized records organized by asset, driver, or date

- Role-based permissions so finance and operations teams can access what they need

- Connected history between mileage logs, inspections, and maintenance records

The best audit strategy is simply keeping things clean and current. Fleetio helps you do that automatically – no more chasing paper trails.

Ready to stop chasing spreadsheets?

See how Fleetio can simplify mileage tracking and streamline compliance across your fleet — with real-time visibility, automated logging, and audit-ready reports.

Book a demoDownload the template

Mileage Log FAQs

An IRS-compliant mileage log includes the date, starting and ending locations, total miles driven, business purpose, and driver name. It should be accurate, consistent, and retained for at least three years in case of audit.

This mileage log template is ideal for U.S.-based fleet managers, small business owners, and team members who drive for work or track vehicle mileage for tax deductions, reimbursements, or maintenance.

Yes. The template captures all the necessary information to calculate and document mileage reimbursement in line with IRS guidelines, making it easy to submit or audit expense reports.

Business mileage includes trips taken for work-related purposes, like meetings, deliveries, or service calls. Personal mileage includes commuting or any non-work-related driving and should be tracked separately.

It’s best to store logs digitally — either in cloud storage or within a fleet management system — to ensure easy access, secure backups, and audit-readiness come tax time.

Software like Fleetio eliminates manual entry, syncs with odometer readings, and ties mileage data to asset maintenance history. It’s ideal for growing fleets or anyone who wants to reduce admin work.