Requesting Funds for Your Fleet: Why Reporting Matters

When requesting additional fleet funds, it pays to be able to back up your claims with data. Here's how to leverage fleet reports to the fullest.

Sep 6, 2024

6 min read

With fleet expenses being costlier than ever, many fleet managers are finding that their current budgets just aren't cutting it. But when organizations are feeling the pinch of inflation across every department, how can fleet managers convince higher-ups that further investment in fleet is necessary?

That's the question we answered in our recent webinar, "Requesting Funds for Your Fleet: Why Reporting Matters."

5 takeaways from our webinar on Fleet Reports for Budgeting

1. Post-pandemic inflation is responsible for cost increases

Listen at 8:29 in the webinar

The pandemic might seem like a distant memory at this point, but the fleet industry is still feeling its aftereffects. Due to historic levels of inflation in recent years, just about every fleet expense has become costlier. From vehicle payments and insurance premiums to parts and employees benefits, operating a fleet requires significantly more capital as of late.

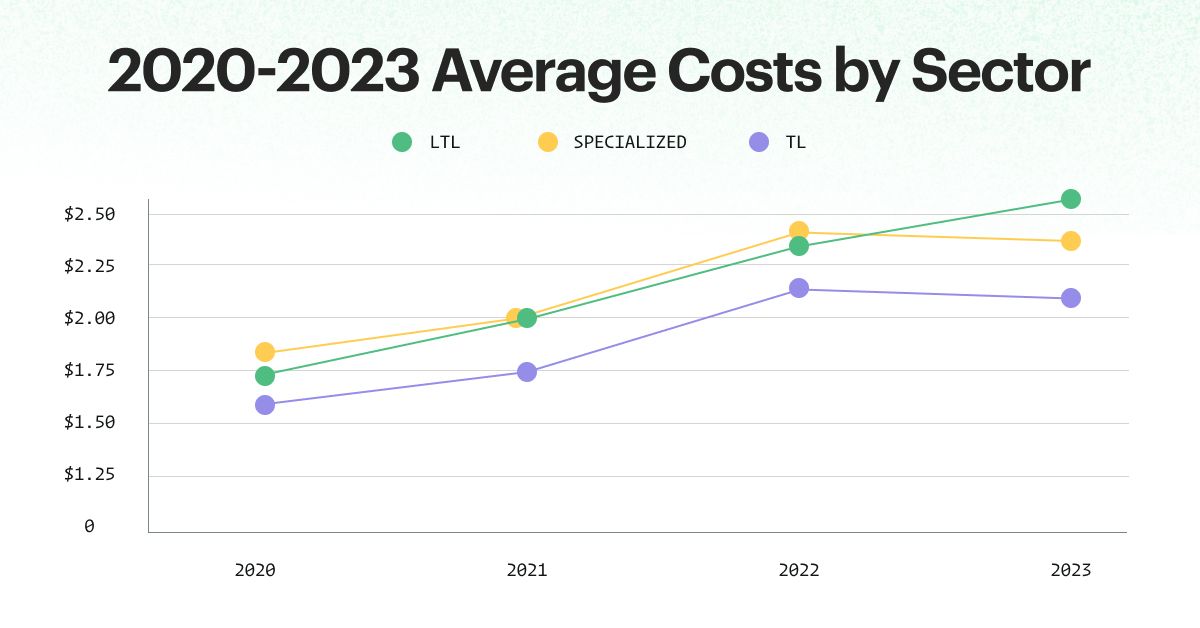

In the webinar, we quantified this across-the-board price surge, by sharing some findings from a report by the American Transportation Research Institute published (ATRI). By collecting data from a wide variety of motor carriers, they discovered that the average cost per mile of the trucking fleets they surveyed went from $1.70 before the pandemic to $2.27 in 2023. And while their research focused on trucking, there's no doubt that the expenses of fleets in all industries have followed a similar trend.

2. Asking for additional budget can feel awkward

Listen at 13:36 in the webinar

Even when all signs indicate that your current fleet budget is insufficient, the idea of asking your boss for more money to work with can rattle even the most steadfast fleet managers. Simply put, no one likes being the bearer of bad news.

But it's important to remember that requiring a larger budget isn't a reflection of your performance as a fleet manager. No amount of belt-tightening could ever counteract the effects of the inflation we saw post-pandemic. So, instead of feeling anxious or even guilty about requesting further fleet funds, try viewing the situation as merely adapting to meet our current economic moment. Given how much we reconfigured our personal and professional lives during the pandemic, an increase in operating budget should seem pretty ordinary in comparison.

3. Non-fleet roles view your costs differently

Listen at 15:30 in the webinar

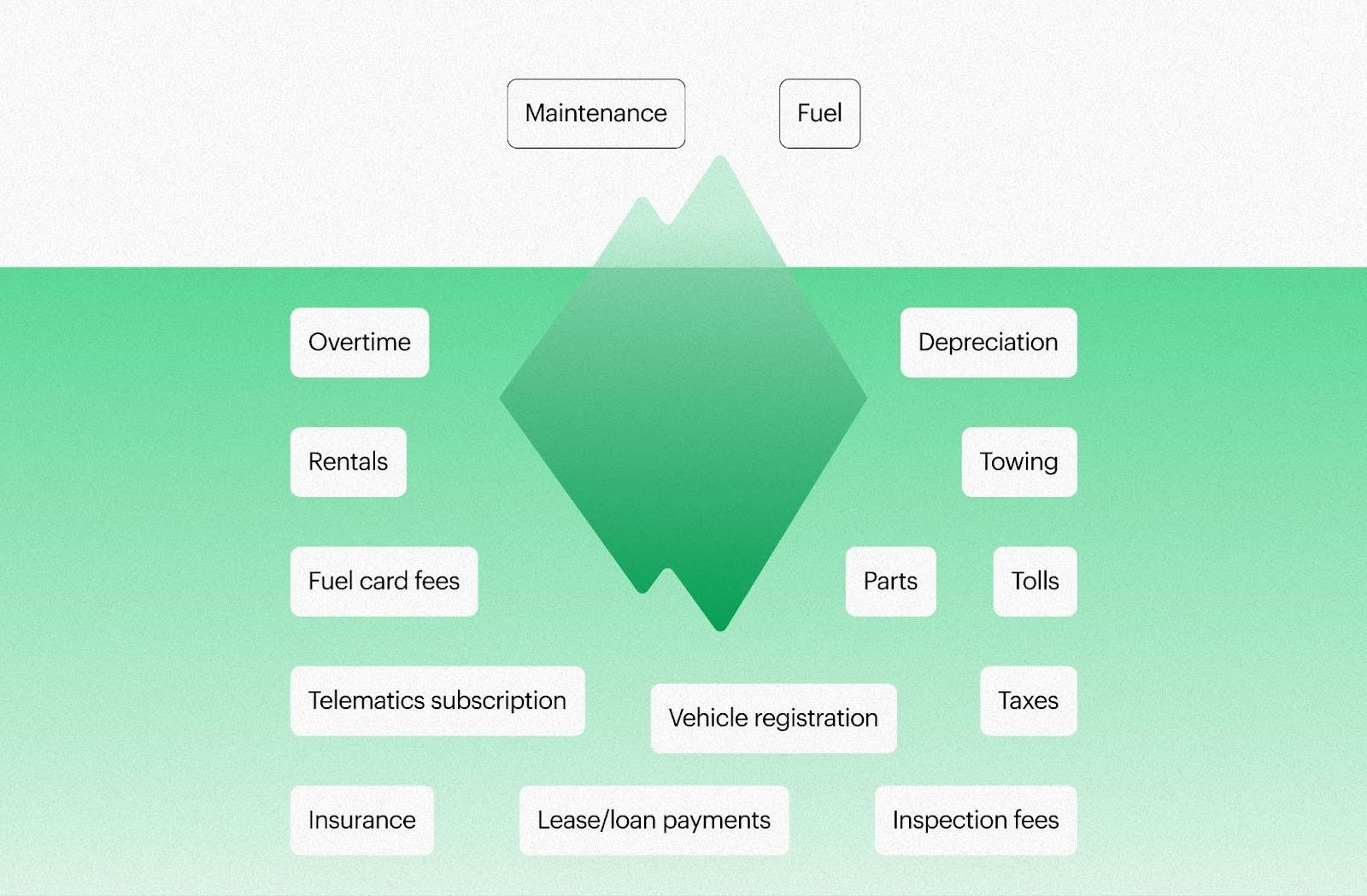

As a fleet manager, you probably have a comprehensive understanding of all the individual expenses that contribute to keeping your vehicles operational. When you think about vehicle-related costs, maintenance and repairs might come to mind first, but things like loan payments, registration fees, insurance premiums, parts and depreciation never get overlooked. On top of that, you likely have a good sense of what your organization spends on telematics subscriptions, fuel card fees, tolls, towing and more.

People who don't work with vehicles perceive fleet costs completely differently. They know vehicles require maintenance, repairs and fuel, so oftentimes they assume those three things are all that's needed to keep a fleet operational. And while that impression is understandable when it's not their line of work, in certain cases, it can become an obstacle.

For example, a CFO unfamiliar with fleet operations might tell you to skimp on preventive maintenance if you tell them your current budget isn't cutting it. In cases like that, fleet reports can help bridge the knowledge gap between you and non-fleet roles through metrics that aren't easily dismissed.

How outsiders see your costs vs. your actual costs

This iceberg graphic illustrates the disparity between fleet and non-fleet professionals when it comes to understanding your expenses. To folks whose work doesn't revolve around vehicles, they can only see what's above the surface (maintenance and fuel). As a fleet manager though, you know that it takes a whole lot more to keep your vehicles operational and cost-efficient.

Understand your operations on a deeper level

Fleetio's robust reporting tools surface the data you need to make informed decisions on behalf of your fleet. Track your operating costs and performance metrics with greater accuracy than ever before.

Take the guesswork out of fleet management4. Data can prove your ability to manage a budget wisely

Listen at 16:58 in the webinar

During the webinar, we shared a bit of wisdom from Bob Polka, Director of Fleet Operations at Treeways, a Pennsylvania-based full-service vegetation management company.

If you can demonstrate that you've got control of your fleet, it's been my experience [stakeholders are] way more inclined to let you have some money, because now they feel like you're going to control that money as well as you're controlling your fleet. Bob Polka, Treeways

As Bob says, if budget controllers at your organization have misgivings about allocating additional budget to fleet operations, you can assuage their concerns by showing you have a proven track record of managing your employer's assets responsibly. And you can demonstrate that history of being a reliable steward via fleet reports.

Listen to our conversation with Bob

For example, if the reason you're requesting additional fleet funds is because your older vehicles are starting to show their age, you can present a maintenance report that breaks down what you're spending on maintenance and repairs per asset. By doing so, you can not only prove the need to replace your older vehicles, but also the fact that you're a cost-conscious and data-minded person. For decision makers worried about needless spending, such demonstrations can go a long way towards getting them on your side.

5. Different reports resonate with different stakeholders

Listen at 19:18 in the webinar

When presenting information to a busy executive, it behooves you to stick to the topics they care about. To that end, instead of sharing dozens of reports to the decision makers at your organization to keep them in the loop, consider tailoring reports to match their areas of interest.

- Fleet Reports for CEOs - When preparing fleet reports for executives, they value high-level ROI-related metrics, so put TCO front and center

- Fleet Reports for COOs - Likely to support fleet investment if better productivity would result, so show them vehicle status and utilization reports

- Fleet Reports for CFOs - Probably unfamiliar with fleet operations and most-concerned with the bottom line; share fuel/maintenance reports to be transparent with expenses

- Fleet Reports for Safety Managers - Not a budget controller, but can be a valuable ally; show them reports related to hours of service, inspection failures and DTC faults

- Fleet Reports for Lead Technicians - Also not in charge of budgeting decisions, but fleet technicians are worth getting on your side; share vehicle status and service summary reports

FOR FLEETIO USERS

Fleetio can automatically send customized reports to whoever you like at whatever cadence you specify (daily, weekly, monthly, etc.).

Discover why fleets choose Fleetio

Thousands of organizations across countless industries rely on Fleetio to manage their fleet activities. No matter the size of your fleet, Fleetio can help you track, analyze and improve your operations.

Book a demo

Fleet Content Specialist

Through interviews, blog posts and webinars, Alex covers the tactics and technologies exceptional fleet managers use to achieve results. By sharing their success stories, his work aims to inform and inspire fleet professionals of all stripes.

LinkedIn|View articles by Alex BorgReady to get started?

Join thousands of satisfied customers using Fleetio

Questions? Call us at 1-800-975-5304