10 Trends and Predictions for Trucking in 2025

Looking ahead to 2025, the trucking and logistics industry faces a shifting landscape as it emerges from the Great Freight Recession. Key factors like freight demand, equipment production and regulatory changes will present both challenges to the unprepared and opportunities to fleets willing to take them.

Dec 19, 2024

9 min read

How is the trucking industry doing?

In short, the past few years in trucking and logistics have been a whole ride. Despite pandemic impacts, looming threats of recessions, supply chain disruptions, roller-coastering fuel prices and labor shortages, the industry’s trajectory has been a steady, plodding and somewhat bumpy uphill trek. While I’d hesitate to say that 2025 is all green lights ahead, I do believe it holds some cautious promise for trucking fleets that approach it with some key factors in mind.

Looking back: How did our 2024 predictions hold up?

My forecasting for 2024 was somewhat on point, but I’m certainly no oracle. Here’s what proved true, somewhat true and kind of not very true when it came to challenges in the trucking industry.

Economic Concerns & Market Recovery

2024 Prediction: I anticipated continued economic concerns and a gradual market stabilization post-Yellow Corporation bankruptcy.

Actual Outcome: The market indeed moved past its bottoming phase from early 2023, but recovery has been slower than expected. High interest, insurance rates and inventory overhangs continued to shape the pace of recovery throughout 2024, but in the end, many have declared the Great Freight Recession to be no more as we move into 2025. My notes about rightsizing were also totally on point — inventory levels were metered to meet lower demand.

Supply Chain Resilience

2024 Prediction: We expected improved adaptation and wider supplier networks.

Actual Outcome: I was almost right but mostly wrong. While supply chains have stabilized, it seems the focus shifted more toward inventory management and cautious fleet investment rather than supplier diversification.

Driver Recruitment

2024 Prediction: I forecasted an increase in the driver shortage to 82,000 in 2024 — or rather, the American Trucking Association did, and I agreed.

Actual Outcome: Again, a correct assessment with a wildly different outcome than I’d imagined. Driver shortages remained a concern, but market overcapacity became a more pressing issue, shifting the narrative from driver shortage to efficient utilization of existing capacity. Allyn International estimates that the shortage amounted to around 52,000 – far less than the ATA estimate. So there’s still a shortage, no doubt, but it seems the industry has routed around some of the impact of that shortage.

E-commerce Impact

2024 Prediction: I argued (uncontroversially) that continued e-commerce growth would drive optimization needs.

Actual Outcome: It wasn’t a revolutionary thought, and the outcome wasn’t exactly staggering either. While e-commerce remained strong, its growth was somewhat moderated by broader consumer spending patterns, though that increased spending continues to influence last-mile delivery demands.

Electrification Progress

2024 Prediction: I expected EV adoption to remain challenged by cost premiums.

Actual Outcome: This prediction proved accurate, with EV implementation still facing prohibitive cost barriers. But it did look like regulatory pressure, particularly through CARB standards adoption across multiple states, would accelerate fleet modernization plans – until we had a definitive outcome for the 2024 presidential election. Now regulation at the federal level is a bit more up in the air, though state-level plans may continue to impact fleets in certain states.

Tech Stack Evolution

2024 Prediction: I guess that fleet would continue with increased technology integration for their operations, with a heightened focus on cybersecurity.

Actual Outcome: It seems I think about cybersecurity a little bit more than the industry at large does. Cybersecurity didn’t crack the top 10 on the ATRI list of transportation industry concerns this year, but Fleet Maintenance isn't convinced that it will stay that way and neither am I.

What’s in store for your fleet in 2025?

Leave inefficiencies in the past. Take full control of your fleet by tracking and optimizing everything — drivers, fuel expenses, maintenance and more — all in one place.

Get after itTop concerns for trucking fleets

We recently sent out an industry survey to both Fleetio customers and non-customers to ask what they were most concerned about leading into the new year. Here were the responses from our trucking respondents, in order:

- The rise of truck fleet operating costs

- The availability of vehicles and parts

- Driver and/or technician labor shortages

- Inconsistent fuel costs

- Adhering to federal and state mandates

- Incorporating alternative fuels and technologies

As James Carville says, “It’s [still] the economy, stupid.” Economic concerns remain a top priority for most fleets, and that's validated by ATRI surveying as well. Fleet professionals in all industries are more motivated to find ways to get control of their budget items, and a little less inclined to be overly concerned with diversifying their asset share. More volatile political concerns like fuel pricing and regulation fell in the middle of the pack.

Pro Tip

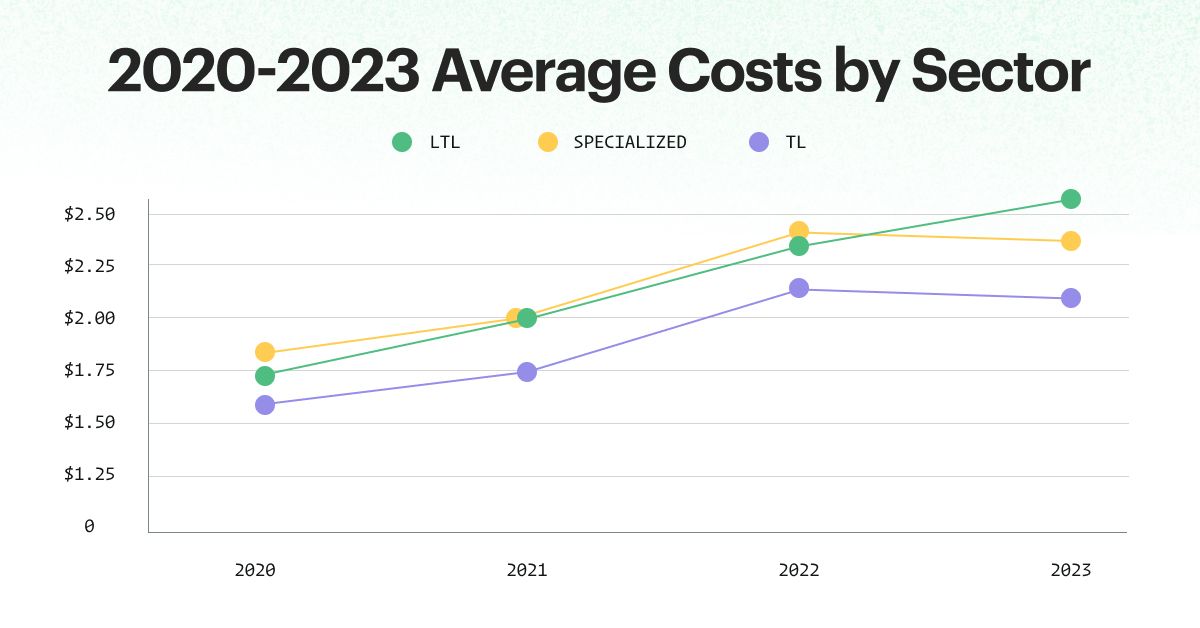

Check out our trucking cost breakdown based on the 2024 ATRI report update.

What should trucking fleets expect in 2025?

Market recovery: Moving past the Great Freight Recession

The industry has turned a corner from the challenging freight recession of 2022-2023. While we're not seeing a dramatic rebound, there are solid signs of improvement across several key areas. Some bright spots, according to BYX:

- Spot rates have leveled out and are moving up and to the right.

- Contract volumes are improving as shippers go back to more normal ordering patterns.

- E-commerce is keeping last-mile delivery demand strong with rising consumer spending.

- Smaller carriers leaving the market have helped balance capacity and recover rates.

But let's be realistic — recovery in freight demand isn't happening at the same pace everywhere, interest rates still affecting fleet buying decisions and some sectors are up against some significant headwinds.

What does that mean for trucking in 2025?

My prediction: The market is healing, but smart fleet managers should stay cautious.

Focus on:- building stronger relationships with reliable shippers,

- keeping equipment well-maintained as replacement costs remain high,

- being selective about which lanes and contracts you commit to,

- and watching for opportunities in growing segments like refrigerated and specialized freight

For most fleets, 2025 won't be about aggressive growth — it'll be about strategic positioning as the market continues to improve. The fleets that ultimately come out on top will be the ones that maintained their equipment and relationships through the downturn and can now capitalize on increasing rates without overextending themselves.

Green mandates vs. real-world decisions

The push toward cleaner trucks might create a tricky situation for fleet managers in 2025 — as I said in my 2024 recap, while some states will continue to push ahead with stricter emissions rules, there's significant uncertainty about how the incoming presidential administration will address federal regulations and incentives, though it looks like it’s going to be a “sweeping rollback,” as Reuters put it. Fleet managers are weighing several practical concerns:

- Cost Realities: Electric trucks still cost a bit more upfront than diesel, even with incentives, though total cost of ownership does seem to be an equalizer — depending on who you ask. Couple acquisition costs with high interest rates, and that's a hard sell for many fleets.

- Infrastructure Gaps: Charging and maintenance infrastructure just isn't where it needs to be for widespread EV adoption despite continued expansion, especially for long-haul routes.

- Political Uncertainty: Potential changes in the federal administration will certainly affect emissions regulations and incentive programs, making long-term planning difficult.

- Proven Technology: Many fleet managers are waiting to see more real-world performance data before making major investments in new technology.

⠀Smart fleet managers should consider taking a balanced approach:

- Meet your minimum compliance requirements if you operate in a regulated state.

- Test alternative fuel vehicles in specific routes or applications where they make the most operational sense.

- Keep well-maintained diesel trucks in the fleet for reliability — plus, a well-maintained ICE vehicle is more environmentally friendly than a malfunctioning one.

- Stay on top of policy changes as you make acquisition decisions.

The key to 2025 isn't rushing into new technology — it's about making calculated decisions based on your specific operations, routes and regulatory requirements.

Many successful fleets are choosing a mixed approach: upgrading to cleaner diesel in some cases, piloting alternative fuels where practical and carefully watching how regulations and incentives develop.Capacity rebalancing: Learning from 2024's winners

The overcapacity challenge that has dominated headlines in 2023-2024 is gradually resolving in some ways, thanks in part to some strategic fleet management across the industry. While we still see more trucks than freight in many markets, successful carriers have shown there are smart ways to traverse this imbalance. With capacity issues still hovering in 2024, we saw savvy fleet operators make calculated adjustments rather than dramatic cuts. ACT Research indicates that the truckload market, in particular, remains out of balance. While some market correction occurred through 2024 as smaller carriers exited the market, overall capacity still exceeds current freight demand.

I’m doubling down on driver retention — instead of focusing on the driver shortage that dominated previous years' discussions, fleets who want to be successful in 2025 should focus on keeping their best drivers happy and busy. It’s likely time to be more selective about which lanes to serve and which contracts to pursue, ensuring consistent work for their core team rather than chasing sporadic opportunities with a larger driver pool.

ACT data shows declining Class 8 truck production expected for 2025, driven by elevated inventory levels and tempered fleet expansion plans. This production slowdown, combined with cautious fleet investment due to high interest rates, suggests a gradual rebalancing process rather than a quick fix.

Overall, the era of aggressive fleet expansion is on pause, but smart operators, especially smaller carriers, are still making targeted investments.

They should focus on replacing aging equipment and retaining their best drivers while being careful about overall fleet size.A few more things I’m keeping my eye on

- I’m convinced this is cybersecurity’s year to emerge as a major concern. Technology adoption continues to grow in trucking conversations, and we’re going to have to reckon with data security at some point.

- Fed rates are always an important watch because of their impact on consumer spending, which continues to be a massive driver for trucking outlooks.

- The potential for more AB-5-style legislation is always looming and could have a huge impact on trucking.

- Infrastructure and tariff impacts are definitely coming in 2025 with the new administration.

- AI is rapidly expanding into trucking technologies in a variety of ways, and it’ll be interesting to see what features launch this year.

- Less trend, more observation: now that we’re back in the full swing of trucking conferences and trade shows post-pandemic, I only see attendance continuing to go up in 2025.

- My ultimate wish for 2025? Let this be the year everyone checks driver CDL statuses before they get dinged on an FMCSA violation in the Roadcheck — it’s been the top violation for 6 years running.

The trucking industry is evolving fast — are you keeping up?

From fuel costs to driver shortages, leading fleets are turning challenges into opportunities with smarter, data-driven solutions. Learn how you can optimize your operations, manage costs and stay ahead in 2025.

Ready? Set. Demo!

Senior Fleet Content Specialist

As a Senior Fleet Content Specialist at Fleetio, Peyton explores the voices and experiences that shape fleet operations. She focuses on how fleet professionals adopt technology, improve efficiency and lead their teams to bring clarity and context to the challenges happening across the industry.

View articles by Peyton PanikReady to get started?

Join thousands of satisfied customers using Fleetio

Questions? Call us at 1-800-975-5304